Most states have statutes that require insurance companies to offer uninsured/underinsured motorist coverage as a part of each automobile/vehicle insurance plan. In most jurisdictions, an individual may be considered underinsured when his or her insurance policy coverage is not enough to fund the full amount of damages he or she is liable for due to an accident or other event covered by his or her policy. In other jurisdictions, a person is considered underinsured when his or her insurance coverage maximum is less than the coverage maximum of the other individual’s (in the accident) policy. Of course, uninsured persons are those who do not carry automobile liability insurance. The purpose of uninsured/underinsured motorist coverage is to protect against situations where one party to the accident does not carry enough insurance or does not carry insurance at all. Therefore, the intent of mandatory uninsured/underinsured motorist coverage is to protect people against monetarily irresponsible individuals who have injured others, due to their own fault, while operating an automobile. If the uninsured or underinsured individual is not at fault, most underinsured/uninsured motorist policies will not apply.

How Uninsured/Underinsured Motorist Coverage Protects You

Who is included?

Generally, uninsured/underinsured motorist insurance coverage will include the named insured (person who has the insurance policy) and the family members who reside in his or her household. Usually, the injured insured person and/or family member must be a passenger in the vehicle, a pedestrian injured by the vehicle or the driver of the vehicle in the accident. In the past, some insurance policies excluded coverage for the insured’s family members. However, these types of exclusions have been found invalid by most state laws. The only time such an exclusion may be found valid is when the family members already have a separate insurance policy of their own. This type of exclusion is valid by most state laws because it is in the interests of public policy and the insurer. Along these lines, an insurance policy may not exclude a family member of the insured who is not covered by the policy, but who is injured while in an automobile that is owned by a family member who is covered by the insured’s insurance policy. It is important to speak to an attorney in your jurisdiction to learn about the uninsured/underinsured motorist coverage and exclusion laws that may apply in your state.

As an employee, am I covered under my employer’s uninsured/underinsured motorist insurance policy?

The courts will look to the language of your employer’s uninsured/underinsured insurance policy to determine who is covered under that policy. The uninsured/underinsured motorist statute in your jurisdiction may also determine who is covered under your employer’s policy. In some jurisdictions, an employee will be covered by his or her employer’s corporate policy if the employee is using his or her own vehicle for business purposes, at the direction of his or her employer. The employee’s personal vehicle may be considered leased, or hired, by the employer. In other jurisdictions, an employee using his or her personal automobile for work purposes will not be covered under the state law’s definition of a “named insured” (person or persons covered under the insurance policy) under the corporate policy.

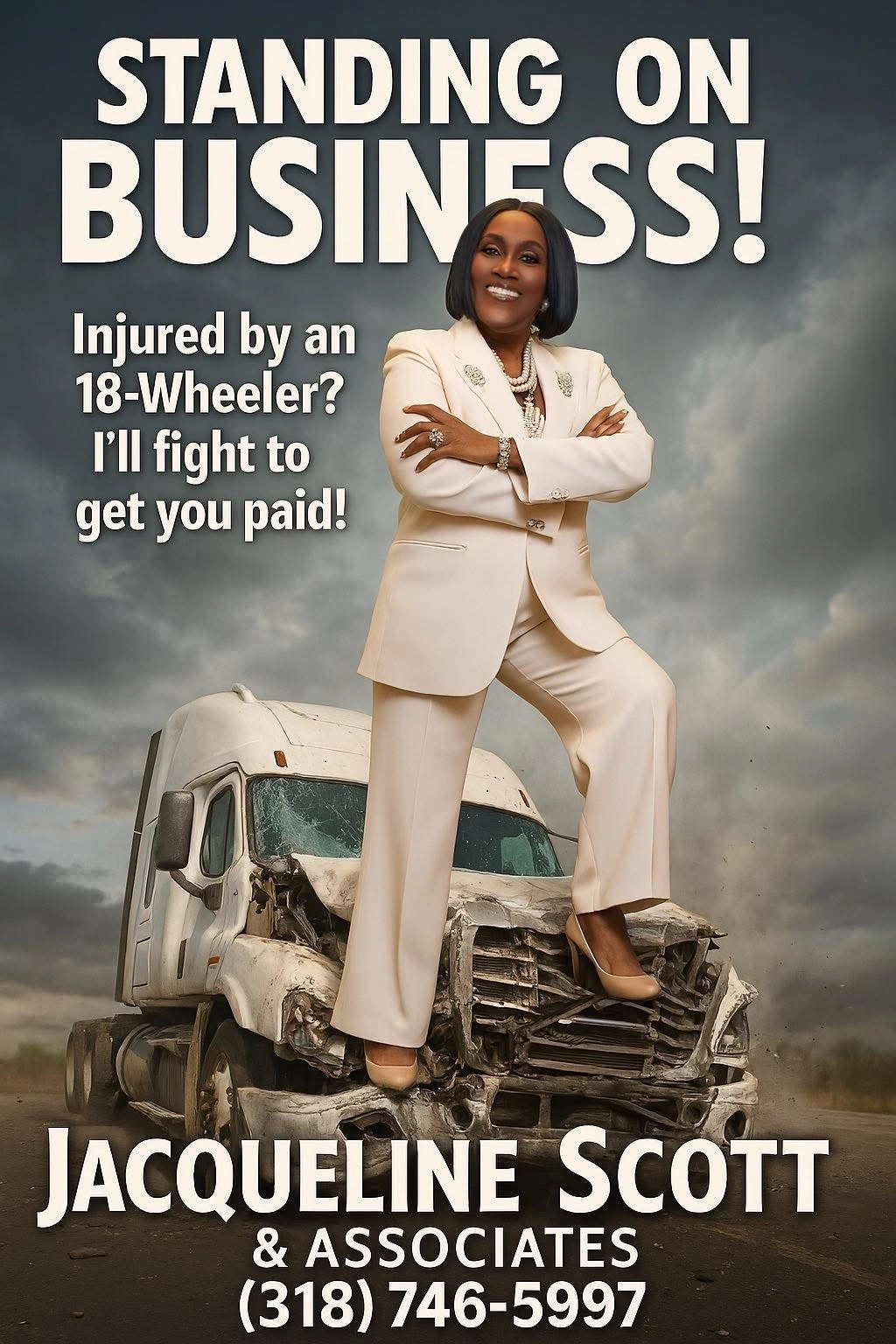

High-Quality Legal Services You Can Rely On

Call Us Today

318-746-5997Our Award-Winning Attorney