Liability insurance is a contract between an individual (insured) and an insurance company. This agreement/policy is carried by an individual (policyholder) to pay any losses or damages that a third party may suffer due to the action of the policyholder. Automobile owners are required to have liability insurance in most states. Once an injury — or property damage — occurs, a claim must be filed with the insurance company. The damages covered by the insured (policyholder’s) policy, which the insured owes to a third party, will be paid by the liability insurance company. Most individuals have comprehensive general liability insurance (CGL). This type of insurance covers a broad range of liability, such as property damage and personal injury. Similarly, some individuals may carry accident-based insurance (or occurrence-based liability insurance). This type of insurance policy also covers property damage and/or personal injuries; however, an action or occurrence must take place in order to activate the policy and the policy may have some exclusions that the insured should be aware of.

Understanding Liability Insurance?

Who (and what) is covered?

Insurance policies may differ; it is important to look at your specific policy to determine the coverage under that policy. Generally, automobile liability insurance covers an accident that occurs during the operation or upkeep of the vehicle listed in the policy. The insurance company agrees to pay for any of the insured’s (policyholder’s) liabilities that arise from an accident that meet the criteria in the insurance contract. Generally, the criteria will be the use or maintenance of the vehicle. However, depending on the type of liability insurance you have and the specific wording in your policy, the criteria could vary. If the automobile is in an accident and it is not during the operation of the vehicle or during maintenance, the accident will usually be covered under the policy if you can show that there is a connection between the automobile and the accident. If the vehicle had not been present, the accident would not have occurred. For example, if the car had not been parked in the parking lot the other car would not have been able to hit it and caused damages to the vehicle.

There should be a “covered persons” section of your liability insurance policy. Look to that section to determine who will be covered under your policy. Generally, persons covered will be the owner (or owners) of the vehicle, the owner’s family members, employees, guests and passengers of the insured. However, if the passenger in the vehicle is not a guest — meaning present in the car without permission — they may not be covered for injuries under the owner’s liability insurance. The purpose of liability insurance is also to protect the insured against claims from third parties. Therefore, the insurance policy should cover claims from insured third parties against the policyholder. Such claims may be from an accident causing property damage or personal injury arising out of use or maintenance of the vehicle covered by the insured’s automobile liability insurance policy.

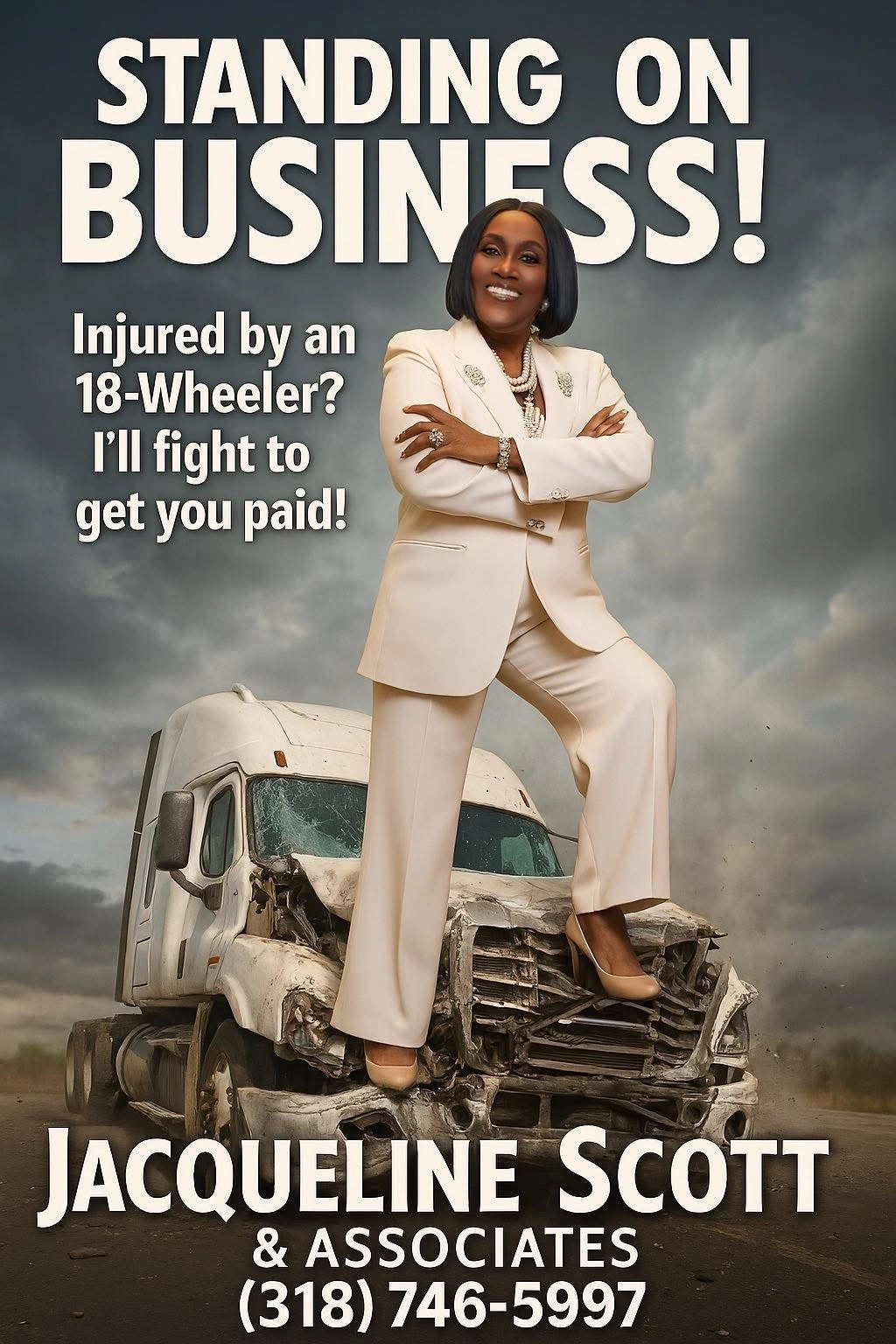

High-Quality Legal Services You Can Rely On

Call Us Today

318-746-5997Our Award-Winning Attorney